|

By Maurice Carter, Sustainable Newton Marketing & Communications Director

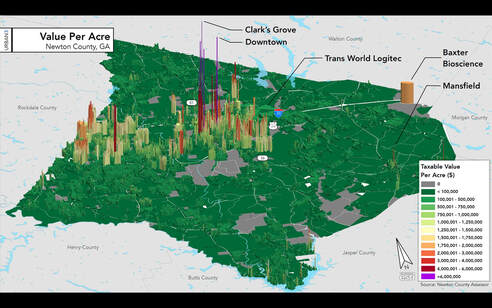

Urban3 mapped where taxable value is created in Newton County Urban3 mapped where taxable value is created in Newton County

The financial model the City of Covington is operating under creates a $8.4M/year shortfall against the long-term maintenance and replacement costs for the city's infrastructure (roads, water and sewer lines, and electric and natural gas lines). And that deficit will grow by that much every year it goes unfunded. Put into practical terms, the city can ultimately only afford 46% of its existing 104 miles of roads inside the city limits. That was the message delivered to elected officials, city staff, and citizens last week by Joe Minicozzi, principle of the consulting firm Urban3.

Covington contracted Urban3 to do a "cost of services" analysis, and Minicozzi was in town last week to share findings and recommend actions the city can take to secure long-term solvency and prosperity. The figures he presented are troubling, but also not surprising. And Minicozzi said as much. Covington's financials are similar to nearly every city and county in America.

I've belonged for years to a non-profit called Strong Towns that publishes articles and podcasts exposing the flawed logic and failed policies by which we've been building American communities since the end of World War II. They've featured Urban3's work often. Strong Towns founder Charles Marohn calls our car-centric development pattern the "Suburban Experiment." For a quick overview of the Strong Towns approach, I recommend this video. To better understand the failings of the "Suburban Experiment," I recommend reading Charles Marohn's article about the "Growth Ponzi Scheme." Covington's situation is not atypical. (Though some cities are in deeper than others, and Minicozzi was able to show Covington officials places in Covington that are already generating positive cash flow today. We just need to expand that model more broadly across the city. You're guessing already where that is. And I'm willing to bet you are wrong. But more on that later.) Before I delve deeper into Urban3's findings in Covington, it might help to watch this short video sharing a case study built from similar Cost of Services studies in a half dozen other cities.

I hope you watched the video, but for those who didn't, here's the net from the narrator:

"In every case, in every region Urban3 has analyzed, traditional mixed-use, walkable neighborhoods dramatically outperform car-centric suburbia." That's not a statement of aesthetics or personal preferences. It's a fact of financial math. Local governments across America can't afford to maintain sprawling road and utility infrastructure at the rate we are building it. And that brings us back to that $8.5M shortfall Covington taxpayers are accruing every year. Writing in the Strong Towns Blog, Charles Marohn summarizes the Urban3 work as "The Real Reason Your City Has No Money." You can watch below Minicozzi's entire presentation to Covington officials Tuesday night. And you really, really should if you own a home or business in Covington. As a shareholder, you have a vested interest. You can also download the presentation materials here. But for those who don't watch the entire presentation, I've summarized some takeaways below.

Urban3 performs an "Economic MRI" for the communities it analyzes, creating a three-dimensional, geospatial model of land profitability throughout the community. The model looks at taxable value per acre for each parcel and also the cost of infrastructure and services. If you read/watched any of the materials linked above, you know cities generate higher economic value per acre than outlying areas. And in cities, the greatest prosperity is found in downtowns with denser, walkable, mixed-use areas.

For the City of Covington, Urban3 found:

Comparing Covington to Newton County as a whole, Urban3 found:

Minicozzi also tackled a common myth spread locally and in communities across America: that multi-family housing is a drain on the local tax base. In reality, the opposite is true in place after place -- including Newton County and Covington. When looking at taxable values across land use type, Urban3 found that:

The highest economic performance comes from multi-story, mixed-use buildings sitting on a smaller footprint, generating more economic activity, and require less infrastructure proportional to the car-centric developments. Stacking matters. At Sustainable Newton, we embrace the Triple Bottom Line -- People, Planet, and Profit -- as the model for measuring sustainability. Suburban sprawl fails against all three. The environmental (planet) impacts of car-centric suburban sprawl have long been obvious: greenhouse gas emissions, particulate pollution, destruction of the tree canopy, and storm water runoff from paving being prime examples. And, from a people perspective, incidents of road rage and the stress of traffic are indicators of what we've given up by moving away from walkable, mixed-use development. But the financial failings of the "Suburban Experiment" are often obscured by how communities think about and measure economic development and financial well-being. As Minicozzi emphasized in his presentation, generally accepted accounting practices show infrastructure (roads, pipes, and transmission lines) as assets on a local government's books, when they should be seen as liabilities. Covington owns 104 miles of roads, 157 miles of stormwater pipe, 200 miles of water pipes, 325 miles of gas pipe, 68 miles of sewer pipe, and 572 miles of electric distribution lines. That's a total of 1,477 miles of infrastructure with a full lifecycle cost of $1.1B, requiring $92M/year to service. Assets are something you can sell for cash. How do you sell a road, sewer pipe, or water line. Instead, the ongoing obligations indicate these should be seen as liabilities. When communities like Covington run up deficits for long-term maintenance and refurbishment of public infrastructure, we invite cataclysm in the form of massive future tax increases , extreme and painful cuts to basic services, or bankruptcy. But it doesn't have to be that way. The recommendations from Urban3 to City of Covington officials:

To be sure, all multi-family or mixed-use developments are not created equal. The quality of the end product matters. But, what we clearly cannot afford is to only grow by adding single-family, detached housing on large lots. Nor can we afford to dedicate valuable land in city centers to parking automobiles. To "thicken up on existing infrastructure," leverage our assets, and plant seeds for our grandkids, we can't just be more open to dense, mixed-use, walkable developments, we need to be identifying our land assets and actively recruiting those developments. I hope that is the message city officials took to heart. The data delivered by Urban3 can help us make better decisions and position elected officials to explain those choices to citizens. And because Newton County and the Newton County Board of Education stand to gain even more than the City of Covington from increase taxable value per acre in the city, this data should lead to more collaboration between local governments with regards to productive land use.

0 Comments

Leave a Reply. |

Categories

All

Archives

February 2024

|

Photos from Chemist 4 U, shixart1985 (CC BY 2.0), Juhele_CZ, EarthLED, shixart1985, EcuaVoz, Chemist 4 U

RSS Feed

RSS Feed